Best Tools in 2025

UPDF AI, Junia AI, Junia AI, aiktp.com, Ryne AI, ModelsLab, AI Blog Writer, Katteb, Journalist AI, BlogFromVideo are the best paid / free tools.

285.100

Insightsoftware delivers finance-focused software solutions designed for financial reporting, business intelligence (BI), budgeting, and enterprise performance management (EPM). With compatibility with more than 140 ERP and EPM systems, the platform enables users to streamline workflows, access up-to-the-minute data, and produce customizable reports in Excel and online. By simplifying financial operations and offering practical insights, Insightsoftware empowers finance professionals to make informed decisions.

Report Writing

11.300

Bookeeping.ai utilizes AI technology to streamline bookkeeping processes, offering automation for tasks like invoicing, expense management, and reporting. The platform features an intuitive chat interface with an AI assistant named Paula, making financial management more efficient for businesses, freelancers, and accountants. By automating mundane tasks, Bookeeping.ai helps users save time and cut costs. With the ability to sync transactions from multiple sources, users can easily handle tax filing and financial analysis without manual entry.

AI Accounting Assistant

16.900.000

Thomson Reuters is a multinational information and technology corporation that offers professionals extensive research, news, and technology services in various fields such as legal, tax, accounting, and other related sectors.

Summarizer

--

CPA Pilot is an AI tax accounting assistant that helps tax accountants 10X their practice by automating research, client communication, and marketing.

Description coming soon...

Featured*

265.300

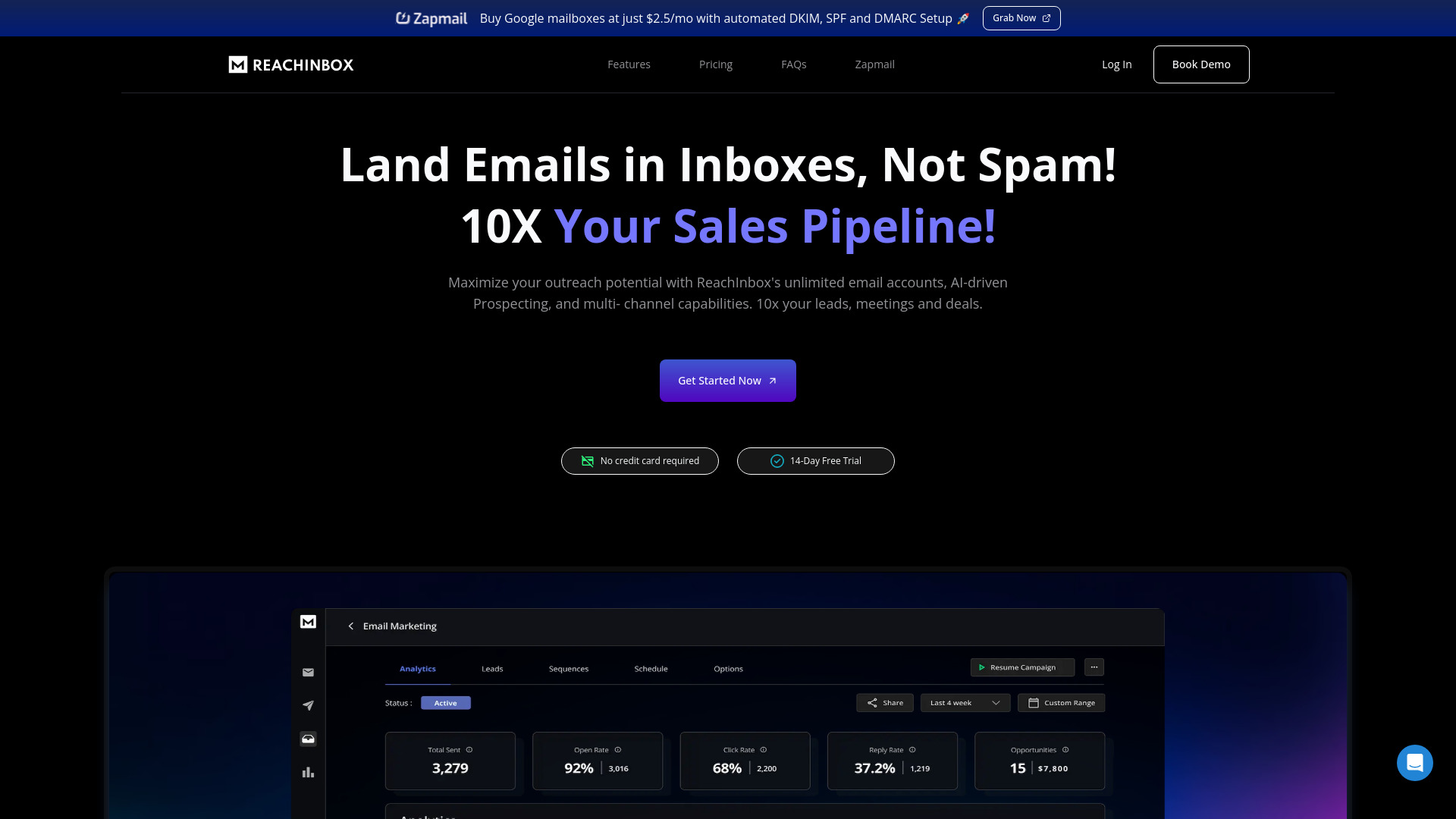

ReachInbox is a cutting-edge AI tool specifically created for cold email outreach. It enhances email deliverability and engagement by utilizing automation, warmups, and multi-channel capabilities.

AI Email Writer